(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

(Amendment No. )

☒ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☐ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material 240.14a-12 | |

PAYMENT OF FILING FEE

☒ | No fee required. | |||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Fee computed on table 0-11. | |||

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

| 320 Park Avenue, 29th Floor New York, NY 10022 (212) 277-7100 |

Dear Stockholder,

2022 was a year marked by disruption and transformation. At EXL, we viewed this as an opportunity. We developed innovative solutions to harness our clients’ data and gain a competitive advantage. Their successes led to our success.

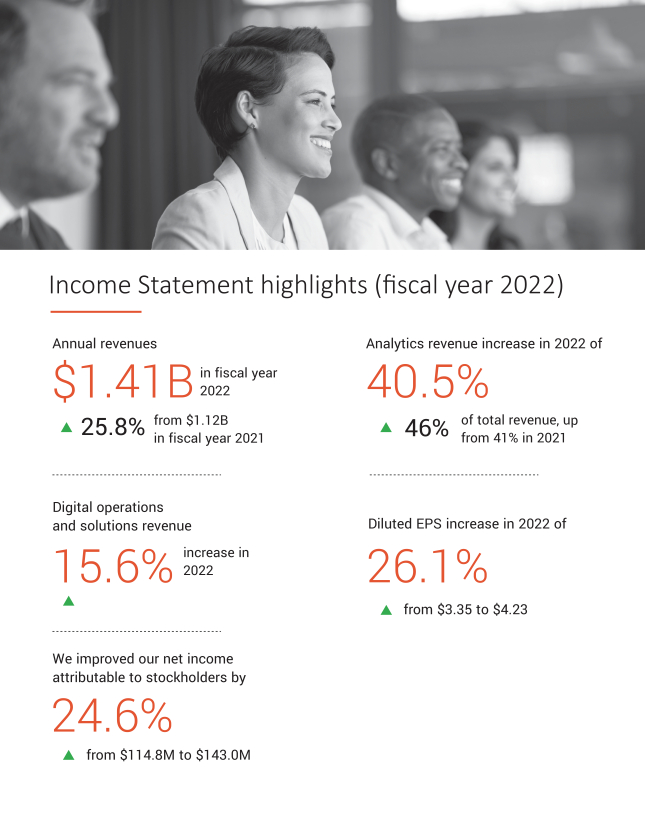

Our headline earnings numbers tell part of the story. In 2022, we generated strong growth across both Analytics and Digital Operations and Solutions. Our 2022 revenue was 1.41 billion, representing growth of 26% over 2021. We also grew adjusted EPS to $6.02, up 25% from $4.83 in 2021.

Our achievements in 2022 are rooted in our unique data-driven capabilities to improve our clients’ operations through digital solutions, enable better decision-making through advanced analytics, and embed intelligence in their workflows through machine learning, AI and automation. Every business today is being challenged to do more with less while customer expectations for speed, personalization and seamless integration continue to expand. EXL harnesses the power of data to help our clients meet those challenges. These data-driven efforts help our clients react faster, reduce costs and build stronger customer experiences. Going forward, we believe this strategy will continue to grow the success of our clients and our success.

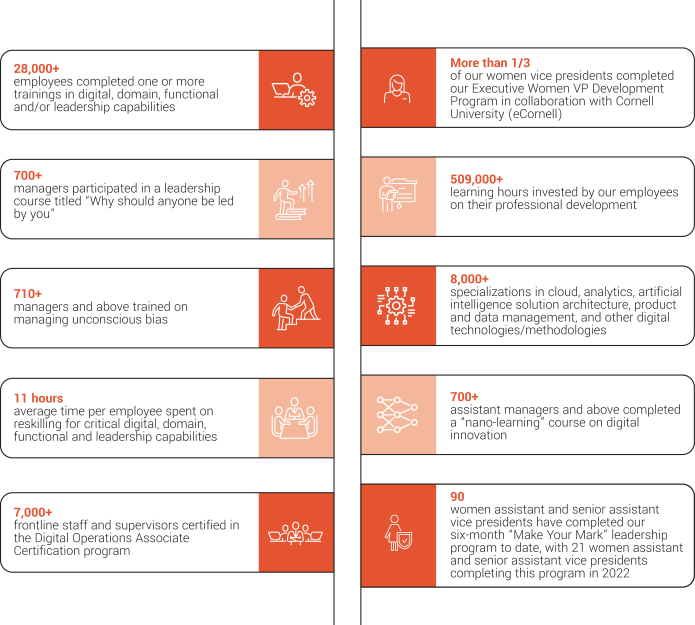

Our ability to execute this strategy is a testament to our talented and steadily growing team of more than 45,400 people, as well as our culture of learning, diversity and experience. Our employees’ creativity and dedication allow EXL to meet market demand and keep pace with our clients’ evolving requirements. In 2022, our employees continued to enhance their expertise, collectively investing more than 509,000 hours in developing their professional skills, functional and leadership capabilities and domain expertise. We achieved more than 8,000 specializations across key areas, such as cloud, analytics and artificial intelligence solution architecture, among others.

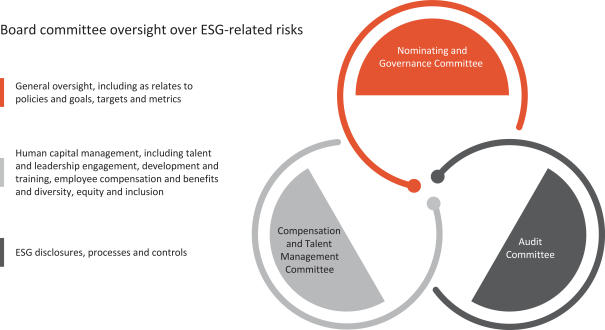

This year’s Proxy Statement continues to highlight progress on our environmental, social and governance (ESG) efforts, which we view as integral to our corporate strategy. In 2022, we made strides toward our transition to sustainable energy and gave back to more than 14,000 people in our communities around the world through volunteering in our signature community engagement initiatives, Skills to Win and Education as a Foundation. We also helped our clients make their businesses more sustainable through the use of cloud services, digital operations and solutions resulting in paper reduction and analytics to meet compliance and risk objectives. We continuously improve on our corporate governance – in 2022, by allocating formal oversight over ESG-related controls and disclosures to our Audit Committee, and by carrying through our board refreshment philosophy to promote the diversity of backgrounds, skills and professional experience among our directors necessary to oversee our evolving corporate strategy, while continuing to hold regular conversations with our stockholders on governance-related topics through our stockholder engagement program. We are proud of this progress, and the external recognitions we received for these efforts, including for the second year as one of America’s Most Responsible Companies by Newsweek and Statista, Inc., and for the second year as one of Barron’s 100 Most Sustainable Companies and a Gold rating from EcoVadis. You can read more about our commitment to ESG issues on our website, in our Sustainability Report and in the “Sustainability” section of this Proxy Statement.

| 2 | / | EXL 2023 Proxy Statement |

PRELIMINARY PROXY STATEMENT

SUBJECT TO COMPLETION

320 Park Avenue, 29th Floor

New York, New York 10022

(212) 277-7100

April 26, 2019

Dear Stockholder:

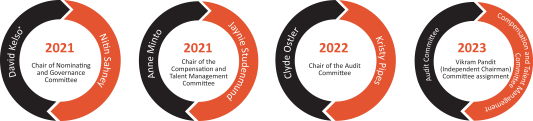

Finally, we would like to thank Anne Minto and Clyde Ostler who will be retiring from our board of directors following our 2023 Annual Meeting of Stockholders. Anne served on EXL’s board for 10 years and Clyde has been on our board since 2007. Both have played key roles in guiding our company to its current position. We would also like to welcome Andreas Fibig, a seasoned global executive with a strong record of innovation across industries and geographies, who joined EXL’s board as an independent director in January 2023, and is standing for reelection at the 2023 Annual Meeting of Stockholders.

On behalf of the board of directors of ExlService Holdings, Inc., we are pleased to invite you to the 20192023 Annual Meeting of Stockholders, which will be held on June 17, 2019 in New York, New York.

The20, 2023. We look forward to sharing more about our Company at the Annual Meeting. We encourage you to carefully read the attached 2023 Annual Meeting will begin with discussion and voting on the matters set forth on the accompanying Notice of the Annual MeetingStockholders and Proxy Statement, followed by discussion of other businesswhich contains important information about the matters properly brought beforeto be voted upon and instructions on how you can vote your shares.

Your vote is important to us. Please vote as soon as possible whether or not you plan to participate in the Annual Meeting.

Pursuant to rules promulgated by the Securities and Exchange Commission, we are providing access to our proxy materials over the Internet. On or about April 26, 2019, we will mail a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) to each of our stockholders of record and beneficial owners at the close of business on April 18, 2019, the record date for the Annual Meeting. On the date of mailing of the Internet Notice, all stockholders and beneficial owners will have the ability to access all of the proxy materials on a website referred to in the Internet Notice. These proxy materials will be available free of charge.

Even if you choose to attend the Annual Meeting in person, you are encouraged to review the proxy materials and vote your shares in advance of the meeting by Internet or phone. The Internet Notice will contain instructions to allow you to request copies of the proxy materials to be sent to you by mail. Any proxy materials sent to you will include a proxy card that you may use to cast your vote by completing, signing and returning the proxy card by mail (or voting instruction form, if you hold shares through a broker). Your vote is extremely important, and we appreciate you taking the time to vote promptly. If you attend the Annual Meeting, you may withdraw your proxy should you wish to vote in person.

The board of directors and management look forward to seeing youyour attendance at the Annual Meeting.

Sincerely,

|  | |

| ||

| ||

| Vikram Pandit Chairman | Rohit Kapoor Vice Chairman and CEO |

| EXL 2023 Proxy Statement | / | 3 |

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

Notice of 2023 Annual Meeting of Stockholders

Dear Stockholder:

You are cordially invited to the 20192023 Annual Meeting of Stockholders of ExlService Holdings, Inc., a Delaware corporation (the “Company”). The Annual Meeting will be held at the New York offices of the Company, 320 Park Avenue, 29th Floor, New York, New York 10022 on June 17, 2019 at 8:30 AM, Eastern Time,, for the purposes of voting on the following matters:

| 1. |

| the election of |

the ratification of the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for fiscal year |

the approval, on a non-binding advisory basis, of the compensation of the named executive officers of the Company; |

| 4. | the determination, on a non-binding advisory basis, of how frequently the stockholders should hold a non-binding advisory vote to approve the compensation of the named executive officers of the Company; |

| 5. | the approval of an amendment to our Amended and Restated Certificate of Incorporation to effect a 5-for-1 “forward” stock split with a corresponding increase in the authorized number of shares of our common stock; |

| 6. | the approval of an amendment to our Amended and Restated Certificate of Incorporation to allow for the removal of directors with or without cause by the affirmative vote of holders of a majority of the total outstanding shares of common stock; and |

| 7. | the transaction of such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

We will hold our Annual Meeting in virtual format only, via live audio webcast (rather than at any physical location) on June 20, 2023 at 8:30 AM, Eastern Time. Our virtual meeting platform will allow for full participation as if you were attending physically. You or your proxyholder may participate, vote, and examine our stockholder list at the Annual Meeting by visiting www.virtualshareholdermeeting.com/EXLS2023 and using your 16-digit control number.

If you are a stockholder of record at the close of business on April 18, 2019,21, 2023, the record date for the Annual Meeting, you are entitled to vote at the Annual Meeting. A list of stockholders as of the record date will be available for examination for any purpose germane to the Annual Meeting, during ordinary business hours, at the Company’s executive offices at 320 Park Avenue, 29th Floor, New York, New York 10022, for a period of 10 days prior to the date of the Annual Meeting and at the Annual Meeting itself. If our corporate headquarters are closed during the 10 days prior to the Annual Meeting, you may send a written request to the Corporate Secretary at our corporate headquarters, and we will arrange a method for you to inspect the list. The list of stockholders will also be available during the Annual Meeting at www.virtualshareholdermeeting.com/EXLS2023.

Please note that there are identification, verification of ownership and otherthe technical requirements for in-personvirtual attendance at the Annual Meeting, as described in the enclosed Proxy Statement beginning on page 11128 under the heading “Information Concerning Voting“Annual Meeting Q&A.”

Pursuant to rules promulgated by the Securities and Solicitation.”Exchange Commission, we are providing access to our proxy materials over the Internet. On or about April 28, 2023, we will mail a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) to each of our stockholders of record and beneficial owners at the close of business on the record date. On the date of mailing of the

| 4 | / | EXL 2023 Proxy Statement |

Internet Notice, all stockholders and beneficial owners will have the ability to access all of the proxy materials on a website referred to in the Internet Notice. These proxy materials will be available free of charge.

Whether or not you expect to attend the Annual Meeting, in person, the Company encourages you to promptly vote and submit your proxy (i) by (i) Internet (by following the instructions provided in the Internet Notice), (ii) by phone (by following the instructions provided in the Internet Notice) or (iii) by requesting that proxy materials be sent to you by mail that will include a proxy card that you can use to vote by completing, signing, dating and returning the proxy card in the prepaid postage envelope provided. Voting by proxy will not deprive you of the right to attend the Annual Meeting or to vote your shares in person.shares. You can revoke a proxy at any time before it is exercised by voting in person at the Annual Meeting, by delivering a subsequent proxy or by notifying the inspector of elections in writing of such revocation prior to the Annual Meeting. YOUR SHARES CANNOT BE VOTED UNLESS YOU EITHER (I) VOTE BY USING THE INTERNET, (II) VOTE BY PHONE, (III) REQUEST PROXY MATERIALS BE SENT TO YOU BY MAIL AND THEN USE THE PROXY CARD PROVIDED BY MAIL TO CAST YOUR VOTE BY COMPLETING, SIGNING AND RETURNING THE PROXY CARD BY MAIL OR (IV) ATTEND THE ANNUAL MEETING AND VOTE IN PERSON.VOTE.

By Order of the Board of Directors

| |

Ajay Ayyappan

Executive Vice President, General Counsel and Corporate Secretary

New York, New York

April 26, 201928, 2023

TABLE OF CONTENTS

| EXL 2023 Proxy Statement | / | 5 |

2023 Proxy Statement

Table of contents

| 7 | ||||

| 61 | ||||

| 63 | ||||

| 63 | ||||

| 86 | ||||

| 87 | ||||

| 6 | / | EXL 2023 Proxy Statement |

PROXY STATEMENT

2019 PROXY STATEMENT SUMMARY2023 Proxy Statement summary

Summary2023 Proxy Statement summary

Summary

Below is a summary of selected keyselect components of this proxy statement,Proxy Statement, including information regarding this year’s stockholder meeting, nominees for our board of directors, summary of our business, performance highlights and selective executive compensation information. This summary does not contain all of the information that you should consider prior to submitting your proxy, and you should review the entire proxy statementProxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 20182022 (the “2018“2022 Form 10-K”). We refer to the fiscal year ended December 31, 2022 as “fiscal year 2022,” “fiscal 2022,” and “2022.”

|

|

|

|

Meeting Agenda, Voting Mattersagenda, voting matters and Recommendationsrecommendations*

| Board vote recommendation | ||||

1. Election of directors |  | FORthe election of (pg. 115) | ||

Required vote: Affirmative vote of | ||||

2. Ratification of appointment of |  | FOR(pg. 117) | ||

Required vote: Affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote | ||||

3. Advisory (non-binding)Say-on-Pay vote to approve executive compensation |  | FOR(pg. 119) | ||

Required vote: Affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote | ||||

4. Advisory (non-binding)Say-on-Frequency vote on the frequency of the |  | EVERY YEAR(pg. 121) | ||

Required vote: The option receiving the | ||||

5. Charter amendment to effect a 5-for-1 “forward” stock split with a corresponding increase in the authorized number of shares of our common stock |  | FOR(pg. 122) | ||

Required vote: Affirmative vote of a majority of the | ||||

6. Charter amendment to allow removal of directors with or without cause by the affirmative vote of holders of a majority of the |  | FOR(pg. 125) | ||

Required vote: Affirmative vote of at least 66 2/3% of the | ||||

* Virtual attendance at our Annual Meeting will constitute presence in person for purposes of | ||||

Annual meeting information | ||||

| Time and date: | |||

| 8:30 AM (Eastern Time) June 20, 2023 | ||||

| Record date: | |||

| April 21, 2023 | ||||

| Place: | |||

| Virtual format only via live audio webcast | ||||

| Voting: | |||

Stockholders as of the | ||||

Board and Corporate Governance Highlights

(Based on current board profile and practices)

| ||||

| Internet (pre-meeting): | |||

| www.proxyvote.com | ||||

| Mail: | |||

Follow instructions on the

| ||||

| Phone: | |||

| Call the number listed on the Internet notice | ||||

| Electronically: | |||

| Attend the Annual Meeting and vote electronically | ||||

If you are the beneficial owner of shares held in the name of a brokerage, bank, trust or other nominee as a custodian (also referred to as shares held in “street name”), your broker, bank, trustee or nominee will provide you with materials and instructions for voting your shares. See page 129 for additional details.

| ||||

| EXL 2023 Proxy Statement |

| 7 |

2023 Proxy Statement summary

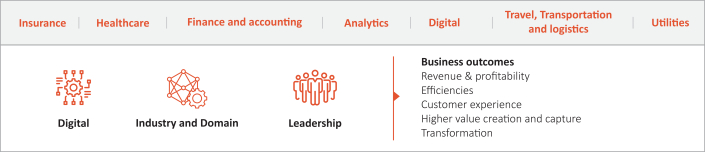

Our business

We are a leading data analytics and digital operations and solutions company that partners with clients to improve business outcomes and unlock growth. By bringing together deep domain expertise with robust data, powerful analytics, cloud, artificial intelligence (“AI”) and machine learning (“ML”), we create agile, scalable solutions and execute complex operations for the world’s leading corporations in industries including insurance, healthcare, banking and financial services, media, and retail, among others. Focused on driving faster decision making and transforming operating models, EXL was founded on the core values of innovation, collaboration, excellence, integrity and respect. Headquartered in New York, our team is over 45,400 strong, with more than 50 offices spanning six continents.

| Company 3 year performance | ||||||||||||||||||||||||

| Revenue (Year-over-year growth %) | ||||||||||||||||||||||||

| Revenue by segment information ($ in millions) | 2020 YOY% | 2021 YOY% | 2022 YOY% | |||||||||||||||||||||

Insurance | $341.8 | -1.3% | $382.0 | 11.8% | $448.7 | 17.5% | ||||||||||||||||||

Healthcare | 101.2 | 4.0% | 112.4 | 10.9% | 97.4 | -13.4% | ||||||||||||||||||

Emerging Business | 152.7 | -19.7% | 167.2 | 9.5% | 218.6 | 30.7% | ||||||||||||||||||

Analytics | 362.7 | 1.5% | 460.7 | 27.0% | 647.3 | 40.5% | ||||||||||||||||||

Consolidated | $958.4 | -3.3% | $1,112.3 | 17.1% | $1,412.0 | 25.8% | ||||||||||||||||||

| 8 | / | EXL 2023 Proxy Statement |

2023 Proxy Statement summary

| EXL 2023 Proxy Statement | / | 9 |

2023 Proxy Statement summary

| 10 | / | EXL 2023 Proxy Statement |

2023 Proxy Statement summary

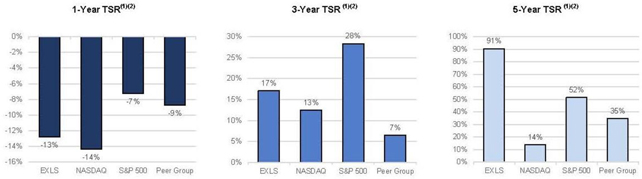

Total stockholder return

The graphs below compare our 1-year, 3-year and 5-year cumulative total stockholder return (“TSR”) as of December 31, 2022 with the median TSR for companies comprising Nasdaq, S&P 600 and our peer group.

| 3-Year TSR

| 5-Year TSR

|

| ||||||||

| EXL 2023 Proxy Statement | / | 11 |

2023 Proxy Statement summary

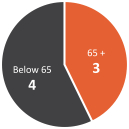

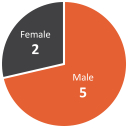

Corporate governance highlights

The following information is based on our board profile immediately following our Annual Meeting (assuming the election of our seven director nominees), and reflects current board practices.

| ||||||||

| ||||||||

/ | EXL 2023 Proxy Statement |

2023 Proxy Statement summary

| EXL 2023 Proxy Statement | / | 13 |

2023 Proxy Statement summary

Nominees for election as directors

| Name | Director since | Business Experience* | Committee membership | ||||

|

Vikram Pandit Chairman |  2018 | Chairman and | Compensation and Talent Management Committee; Nominating and Governance Committee | |||

|

Rohit Kapoor Vice Chairman |  2002 | |||||

Co-founded the Company in | None | ||||||

| January 2023 | Former Chairman and | Audit Committee; Nominating and Governance Committee | ||||

Som Mittal | December 2013 | Former Chairman and President of NASSCOM; various corporate leadership roles in the IT industry including at Wipro, Compaq, | Compensation and Talent Management Committee; Nominating and Governance Committee | ||||

Kristy Pipes | January 2021 | Former Chief Financial Officer of Deloitte Consulting; various leadership roles in the financial services industry, including at Transamerica Life Companies and First Interstate Bank of California | Audit Committee (Chair); Compensation and Talent Management Committee | ||||

Nitin Sahney | January 2016 | Founder and Chief Executive Officer of Pharmacord, LLC; former President and CEO of Omnicare Inc. | Nominating and Governance Committee (Chair); Audit Committee | ||||

Jaynie Studenmund

| September 2018 | Former Chief Operating Officer of Overture Services, Inc.; | Compensation and | Talent Management Committee (Chair); Audit Committee | |||

* A complete list of each nominee’s business experience and directorships is listed below beginning on page 20. | |||||||

| 14 | / | EXL 2023 Proxy Statement |

2023 Proxy Statement summary

Director nominees - skills matrix

|  |  |  |  |  |  |  |  |  |  |  | |||||||||||||

| Finance and accounting | Executive leadership | Public company governance | Analytics | Human capital management | Digital operations and solutions | Marketing | Global experience | Risk oversight and management | Information and cyber security | ESG | Mergers acquisitions | |||||||||||||

Vikram Pandit | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||

Rohit Kapoor | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

Andreas Fibig | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||

Som Mittal | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||

Kristy Pipes | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||

Nitin Sahney | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||

Jaynie Studenmund | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

Board statistics*

Board tenure

| Gender diversity

| Age distribution

|

Board independence

| Racial and ethnic diversity

|

*A complete list Following our Annual Meeting, assuming election of each nominee’s business experience and directorships is listed below on page 17.all nominees

| EXL 2023 Proxy Statement | / | 15 |

2023 Proxy Statement summary

Our Business purpose and core values

We are an operations management and analytics company

Sustainability

At EXL, we believe that helps businesses enhance revenue growth and improve profitability. Using proprietary platforms, methodologies and our full range of digital capabilities,there is always a better way; we look deeper, find it, and make it happen. This purpose informs our corporate culture, which, in turn, is rooted in our five core values. In line with our purpose, values and culture, we are committed to help companies transform their businesses, functionsfinding a better way through sustainability initiatives that are key to our long-term strategy and operations, to help them deliver better customer experiencebenefit our stockholders, clients, employees and business outcomes, while managing risk and compliance. We servecommunities. See “Sustainability” beginning on page 48 below for more details on our customersrecent accomplishments in the insurance, healthcare, travel, transportation and logistics, banking and financial services and utilities industries, among others. Headquartered in New York, we have approximately 29,100 professionals in locations throughout the United States, Europe, Asia (primarily India and the Philippines), Latin America, Australia and South Africa.sustainability.

Performance Highlights for 2018

Company 3 Year Performance Revenue and Segment Information ($ in millions) | ||||||||

| Revenue (Year-over-year growth %) | ||||||||

| 2016 | YOY% | 2017 | YOY% | 2018 | YOY% | |||

| Insurance Segment | $206.3 | 3.2% | $234.8 | 13.8% | $258.1 | 9.9% | ||

| Healthcare Segment | 68.7 | 24.4% | 77.0 | 12.2% | 84.4 | 9.6% | ||

| Travel, Transportation and Logistics Segment | 69.4 | 11.4% | 71.0 | 2.3% | 70.2 | -1.0% | ||

| Finance and Accounting Segment | 79.4 | 1.2% | 86.5 | 9.0% | 97.9 | 13.2% | ||

| All Other | 96.5 | -12.7% | 83.1 | -13.9% | 87.2 | 4.8% | ||

| Analytics Segment | 165.7 | 35.7% | 209.9 | 26.7% | 285.3 | 35.9% | ||

| Consolidated | $686.0 | 9.1% | $762.3 | 11.1% | $883.1 | 15.8% | ||

We improved our annual revenues from $762.3 million in fiscal year 2017 to $883.1 million in fiscal year 2018, and also achieved numerous other successes, including the acquisition of a healthcare analytics company and a $150 million strategic investment in our Company by The Orogen Group. For more information regarding these and other business highlights, please see page 35 below and the 2018 Form 10-K.

The graphs below compare our 1-year, 3-year and 5-year total stockholder return (“TSR”) with that of the companies comprising Nasdaq, S&P 500 and our peer group. As shown in the table, our 3-year TSR outperformed all but one of our market benchmarks while our 5-year TSR outperformed all of our market benchmarks.

(1) Cumulative growth rate as of December 31, 2018.

(2) Peer group TSR data excludes Convergys Corporation, which was acquired in October 2018, and DST Systems, which was acquired in April 2018.

2018 Compensation Highlights

| 16 | / | EXL 2023 Proxy Statement |

2023 Proxy Statement summary

2022 Compensation highlights

Named Executive Officers

| Name | Title | |

Rohit Kapoor | Vice Chairman and CEO | |

Maurizio Nicolelli | Executive Vice President and CFO | |

Vikas Bhalla | Executive Vice President and | |

Vivek Jetley | Executive Vice President and Business Head, Analytics | |

Ankor Rai | Executive Vice President and Chief | |

2022 Standard annual compensation

| 2018 Standard Annual Compensation | |||||

| Compensation Component | Rohit Kapoor | Vishal Chhibbar | Pavan Bagai | Nagaraja Srivatsan | Nalin Miglani |

| Salary | $720,000 | $437,671 | $301,448 | $441,370 | $440,137 |

| Non-Equity Incentive Plan Compensation | 532,748 | 173,210 | 133,946 | 172,987 | 164,579 |

| Equity Awards | 3,791,277 | 928,709 | 1,339,363 | 753,076 | 809,936 |

| Other Compensation(1) | 61,484 | 11,465 | 74,407 | 8,640 | 8,640 |

| Total | $5,105,509 | $1,551,056 | $1,849,164 | $1,376,073 | $1,423,292 |

| Compensation component | Rohit Kapoor | Maurizio Nicolelli | Vikas Bhalla(3) | Vivek Jetley | Ankor Rai | |||||||||||||||

| Salary | $766,384 | $483,822 | $265,432 | $440,164 | $420,082 | |||||||||||||||

| Non-equity incentive plan compensation | 1,829,887 | 554,929 | 357,340 | 525,488 | 481,822 | |||||||||||||||

| Equity awards (1) | 8,356,213 | 1,810,865 | 1,964,960 | 1,862,689 | 1,553,192 | |||||||||||||||

| Other compensation (2) | 58,423 | 9,654 | 38,432 | 9,654 | 9,654 | |||||||||||||||

| Total | $11,010,906 | $2,859,270 | $2,626,165 | $2,837,996 | $2,464,750 | |||||||||||||||

(1) Equity award values reflect equity grants in 2022 based on the grant date fair value of awards in accordance with FASB ASC Topic 718.

(2) For each named executive officer, this category includes, if applicable, his perquisites and personal benefits, hiring bonus, changes in pension value, Company-paid life insurance premiums and Company contributions to our 401(k) plan. A detailed discussion of the compensation components for each named executive officer for fiscal year 2022 is provided in the “Summary compensation table for fiscal year 2022” beginning on page 87.

(3) Mr. Bhalla is based in Delhi, India. Certain of his compensation components, as described herein, are paid in Indian rupees (INR), and are converted for comparison purposes at 82.72 INR to 1 U.S. Dollar (USD), which was the exchange rate on December 30, 2022.

On an annual basis, we submit to our stockholders a vote to approve, on a non-binding advisory basis, the compensation of our named executive officers as described in this proxy statement.Proxy Statement. We refer to this vote as “say-on-pay”“say-on-pay”. Please refer to our Compensation Discussion and Analysis, startingbeginning on page 3563 for a complete description of our 20182022 compensation program.

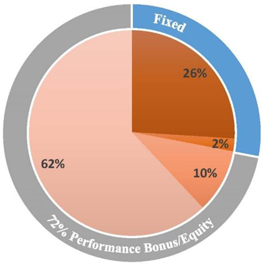

Below are a few highlights of our executive compensation:

Compensation philosophy: Our executive compensation philosophy is focused on pay-for-performance and is designed to reflect appropriate governance practices aligned with the needs of |

| EXL 2023 Proxy Statement | / | 17 |

2023 Proxy Statement summary

| • | 99% Say-on-Pay approval of 2021 compensation: At our |

Annual |

| – | Company-wide metrics (75%)—Revenue and adjusted operating profit |

| – |

Individual |

Long-term equity incentive program: We also continued our equity incentive program, which includes granting a balanced mix of time-vested restricted stock units and performance-based restricted stock units. The performance-based restricted stock units were comprised |

2022 performance: We delivered the following revenue and |

| – | Annual |

| – | Equity |

| 18 | / | EXL 2023 Proxy Statement |

2023 Proxy Statement summary

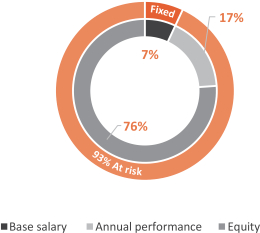

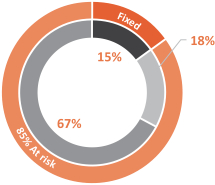

Compensation Mix:mix

Vice Chairman & CEO compensation mix | NEO (Excluding Vice Chairman & CEO) | |

| ||

|

|

Auditor Matters

As a matter of good corporate practice, we are seeking your ratification of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2019. The following sets forth fees of Deloitte & Touche LLP, who served as our independent registered public accounting firm for fiscal year 2018.

2018 (in thousands) | ||

| Audit Fees | $ | 1,425 |

| Audit-Related Fees | — | |

| Tax Fees | 523 | |

| All Other Fees | 54 | |

| Total | $ | 2,002 |

For more information on our auditors, including individual components of 2018 audit fees and our change in auditors, see page 82.

INFORMATION CONCERNING VOTING AND SOLICITATION

This Proxy Statement is being furnished to you in connection with the solicitation by the board of directors of ExlService Holdings, Inc., a Delaware corporation (“us,” “we,” “our” or the “Company”), of proxies to be used at our 2019 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the New York offices of the Company, 320 Park Avenue, 29th Floor, New York, New York, 10022 on June 17, 2019, at 8:30 AM, Eastern Time, and any adjournments or postponements thereof.

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each stockholder of record, the Company furnishes proxy materials via the Internet. If you received a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) by mail, you will not receive a printed copy of our proxy materials other than as described herein. Instead, the Internet Notice will instruct you as to how you may access and review all of the important information contained in the proxy materials. The Internet Notice also instructs you as to how you may submit your proxy over the Internet or by phone. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting proxy materials included in the Internet Notice.

It is anticipated that the Internet Notice will be sent to stockholders on or about April 26, 2019. This proxy statement and the form of proxy relating to the Annual Meeting will be made available via the Internet to stockholders on or prior to the date that the Internet Notice is first sent.

Who Can Vote

Only stockholders who own shares of our common stock at the close of business on April 18, 2019, the record date for the Annual Meeting, can vote at the Annual Meeting. As of the close of business on April 18, 2019, the record date, we had [___________] shares of common stock outstanding and entitled to vote. Each holder of common stock is entitled to one vote for each share held as of the record date for the Annual Meeting. There is no cumulative voting in the election of directors.

How You Can Vote

If your shares are registered directly in your name with Computershare Trust Company, N.A., our transfer agent (which means you are a “stockholder of record”), you can vote your proxy by (i) Internet, (ii) by phone or (iii) by requesting that proxy materials be sent to you by mail that will include a proxy card that you can use to vote by completing, signing, dating and returning the proxy card in the prepaid postage envelope provided. Please refer to the specific instructions set forth in the Internet Notice. You will not be able to vote your shares unless you use one of the methods above to designate a proxy or by attending the Annual Meeting.

If you are the beneficial owner of shares held in the name of a brokerage, bank, trust or other nominee as a custodian (also referred to as shares held in “street name”), your broker, bank, trustee or nominee will provide you with materials and instructions for voting your shares. In addition to voting by mail, a number of banks and brokerage firms participate in a program provided through Broadridge Financial Solutions, Inc. (“Broadridge”) that offers telephone and Internet voting options. Votes submitted by telephone or by using the Internet through Broadridge’s program must be received by 11:59 p.m. Eastern Time, on June 16, 2019.

Voting at the Annual Meeting

Voting by Internet, phone or mail will not limit your right to vote at the Annual Meeting if you decide to attend in person. Our board of directors recommends that you vote by Internet, phone or mail as it is not practical for most stockholders to attend the Annual Meeting. If you are a “stockholder of record,” you may vote your shares in person at the Annual Meeting. If you hold your shares in “street name,” you must obtain a proxy from your broker, bank, trustee or nominee giving you the right to vote the shares at the Annual Meeting or your vote at the Annual Meeting will not be counted.

Revocation of Proxies

You can revoke your proxy at any time before it is exercised in any of the following ways:

/ | 19 |

Required Vote; Effect of Abstentions and Broker Non-Votes

Quorum

A quorum, which is a majority of the issued and outstanding shares of our common stock as of April 18, 2019, must be present, in person or by proxy, to conduct business at the Annual Meeting. A quorum is calculated based on the number of shares represented by the stockholders attending the Annual Meeting in person and by their proxy holders. If you indicate an abstention as your voting preference for all matters to be acted upon at the Annual Meeting, your shares will be counted toward a quorum but they will not be voted on any matter.

Proposal 1: Amendment of the Amended and Restated Certificate of Incorporation to Effect a Phased Declassification of the Board of Directors over the Next Three Years

We are seeking approval of an amendment of Section 6 of our Amended and Restated Certificate of Incorporation to declassify the board over a three-year phase out period (see page 78 below), which when completed will allow for the election of all directors on an annual basis. This requires the affirmative vote of the holders of at least 66 2/3% of the voting power of the then-outstanding shares of the Company, voting together as a single class. For purposes of the vote on Proposal 1, abstentions and broker non-votes (as described below) will have the effect of a vote against Proposal 1.

Proposal 2: Election of Directors

Under our Fourth Amended and Restated By-Laws (our “by-laws”), directors who are standing for election at the Annual Meeting will be elected by the affirmative vote of a majority of votes cast (meaning the number of shares voted “for” a nominee must exceed the number of shares voted “against” such nominee) by stockholders in person or represented by proxy and entitled to vote at the Annual Meeting. If any incumbent nominee for director receives a greater number of votes “against” his or her election than votes “for” such election, our by-laws provide that such person shall tender to the board of directors his or her resignation as a director. You may cast your vote in favor of electing all of the nominees as directors, against one or more nominees, or abstain from voting your shares. For purposes of the vote on Proposal 2, abstentions and broker non-votes will have no effect on the results of the vote.

Other Proposals

The ratification of the appointment of our independent registered public accounting firm, the advisory (non-binding) approval of the compensation of our named executive officers and each other item to be acted upon at the Annual Meeting will require the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the Annual Meeting. You may cast your vote in favor of or against these proposals or you may abstain from voting your shares. For purposes of the vote on Proposals 3 (ratification of the appointment of our independent registered public accounting firm), 4 (advisory (non-binding) vote on executive compensation), or such other items properly presented and to be acted upon at the Annual Meeting, abstentions will have the effect of a vote against these proposals. Broker non-votes will have the effect of a vote against Proposal 4, but because Proposal 3 is a “routine” proposal where brokers have discretionary authority to vote in the absence of instruction, there will be no broker non-votes.

If you submit your proxy, but do not mark your voting preference, the proxy holders will vote your shares (i) FOR the amendment of the amended and restated certificate of incorporation, (ii) FOR the election of the Class I nominees for director, (iii) FOR the ratification of the appointment of our independent registered public accounting firm, (iv) FOR the approval on an advisory (non-binding) basis of the compensation of our named executive officers, and (v) as described below, in the judgment of the proxy holder on any other matters properly presented at the Annual Meeting.

Shares Held in “Street Name” by a Broker

If you are the beneficial owner of shares held in “street name” by a broker, then your broker, as the record holder of the shares, must vote those shares in accordance with your instructions. If you fail to provide instructions to your broker, under the New York Stock Exchange rules (which apply to brokers even though our shares are listed on the NASDAQ Stock Market), your broker will not be authorized to exercise its discretion and vote your shares on “non-routine” proposals, including the election of directors and approval on an advisory (non-binding) basis of the compensation of our named executive officers. As a result, a “broker non-vote” occurs. However, without your instructions, your broker would have discretionary authority to vote your shares only with respect to “routine” proposals, which at the Annual Meeting is the ratification of the appointment of our independent registered public accounting firm.

Other Matters to Be Acted Upon at the Meeting

Our board of directors presently is not aware of any matters, other than those specifically stated in the Notice of Annual Meeting, which are to be presented for action at the Annual Meeting. If any matter other than those described in this proxy statement is presented at the Annual Meeting on which a vote may properly be taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those shares.

Adjournments and Postponements

Any action on the itemsOur board of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

Solicitation of Proxies

We will pay the cost of printing and mailing proxy materials and posting them on the Internet. Upon request, we will reimburse brokers, dealers, banks and trustees, or their nominees, for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of shares of our common stock.

Internet Availability of Proxy Materials

Our Notice of Annual Meeting, proxy statement and form of proxy card are each available atwww.proxyvote.com. You may access these materials and provide your proxy by following the instructions provided in the Internet Notice.

Important

Please promptly vote and submit your proxy by (i) Internet (by following the instructions provided in the Internet Notice), (ii) by phone (by following the instructions provided in the Internet Notice) or (iii) by requesting that proxy materials be sent to you by mail that will include a proxy card that you can use to vote by completing, signing, dating and returning the proxy card in the prepaid postage envelope provided. This will not limit your right to attend or vote at the Annual Meeting. All Annual Meeting attendees may be asked to present valid, government-issued photo identification (federal, state or local), such as a driver’s license or passport, and proof of beneficial ownership if you hold your shares through a broker, bank, trust or other nominee (or a proxy signed by a stockholder of record delegating voting authority to the attendee), before entering the Annual Meeting. Attendees will be required to sign in, and may be subject to security inspections. Video and audio recording devices and other electronic devices will not be permitted at the Annual Meeting.

If you have any further questions about voting your shares or attending the Annual Meeting, please call our Investor Relations Department at (212) 624-5913.

directors

Our board of directors currently consists of tennine directors divided into three classes, with each(including our seven director serving a three-year termnominees, and one class being elected at each year’s annual meeting of stockholders.* The current compositiontwo of our directors who currently serve on the board, of directors is as follows:but will not stand for reelection) with diverse experience, including in analytics, digital operations and solutions, client industries, information and cybersecurity, human capital management, ESG, and finance and accounting, among others.

From left: Clyde Ostler* (Independent Director), Nitin Sahney (Independent Director and Nominating and Governance Committee Chair), Kristy Pipes (Independent Director and Audit Committee Chair), Rohit Kapoor (Vice Chairman and CEO), Jaynie Studenmund (Independent Director and Compensation and Talent Management Committee Chair), Andreas Fibig (Independent Director), Vikram Pandit (Independent Chairman), Som Mittal (Independent Director), Anne Minto* (Independent Director)

* Not standing for reelection

|

|

| ||||||

/ | ||||||||

| EXL 2023 Proxy Statement |

Our board of directors

Board diversity matrix

2023 Board diversity matrix (as of April 28, 2023)*

Total number of directors: | 9 | |||

| Female | Male | |||

| Part I: Gender identity | ||||

Directors | 3 | 6 | ||

| Part II: Demographic background | ||||

Asian | — | 4 | ||

White (other than Middle Eastern) | 3 | 2 | ||

* Subject to approval by the Company’s stockholders of Proposal 1Includes our nine current directors, including our seven nominees for election at the Annual Meeting, theMeeting.

2022 Board diversity matrix (as of April 28, 2022)

Total number of directors: | 9 | |||

| Female | Male | |||

| Part I: Gender identity | ||||

Directors | 3 | 6 | ||

| Part II: Demographic background | ||||

Asian | — | 4 | ||

White (other than Middle Eastern) | 3 | 2 | ||

| EXL 2023 Proxy Statement | / | 21 |

Our board of directors will be declassified and elected annually over a three-year phase-out period.

**Mr. Pandit was appointed to the board as a Class III director under the terms of an Investment Agreement as described on page 16 below.

2019 Nominees

Director nominees for election at the Annual Meeting

Upon the recommendation of our Nominating and Governance Committee, we are pleased to propose seven of our three (3) existing Class I directors as nominees for re-electionelection as directors at the Annual Meeting. As previously disclosed, two of our current directors, Ms. Minto and Mr. Ostler, will not be standing for re-election at the Annual Meeting; the remaining seven directors are our director nominees at the Annual Meeting.

If Proposal 1 is approved by the Company’s stockholders,upon the filing of the amendment to the certificate of incorporation set forth on Appendix A attached hereto, the classificationThe following tables provide a summary of our board composition by age, gender, tenure and independence immediately after our Annual Meeting (assuming the election of all nominees).

| Age distribution | Gender diversity | Board tenure | Board independence | |||

|  |  |  | |||

Our nominees for re-election as directors will be phased out over the next three Annual Meetings of Stockholders, such that directors will be elected annually. Accordingly, (i) at the Annual Meeting each of the Class I director nominees elected by our stockholders will be elected to hold office for a term of one year, or until their successors are duly elected and qualified in accordance with our by-laws, (ii) at the 2020 Annual Meeting of Stockholders, each of the Class I and Class II director nominees elected by our stockholders will be elected to hold office for a term of one year, or until their successors are duly elected and qualified in accordance with our by-laws, and (iii) at the 2021 Annual Meeting of Stockholders, each of Class I, Class II and Class III director nominees elected by our stockholders will be elected to hold office for a term of one year, or until their successors are duly elected and qualified in accordance with our by-laws, and thereafter the classification of the board of directors will terminate in its entirety. As such, if elected, each of the Class I director nominees will serve a term or one year on our board of directors, until our 2020 Annual Meeting of Stockholders or until their successors are duly elected and qualified in accordance with our by-laws.as follows:

If Proposal 1 is not approved by the Company’s stockholders, and if elected, each of the Class I director nominees will serve a term of three years on our board of directors, until our 2022 Annual Meeting of Stockholders or until their successors are duly elected and qualified in accordance with our by-laws.

|

and Independent Director | |||||

| Rohit Kapoor Vice Chairman and CEO and Director | |||||

| Andreas Fibig Independent Director |

| Som Mittal Independent Director | |||

| Kristy Pipes Independent Director and Chair of the Audit Committee |

| Nitin Sahney Independent Director and Chair of the Nominating and Governance Committee | |||

| ||||||

| Jaynie Studenmund Independent Director and Chair of the Compensation and Talent Management Committee | |||||

We believe that our director nominees and continuing directors, individually and together as a whole, possess the requisite skills, experience and qualifications necessary to maintain an effective board to serve the best interests of the Company and its stockholders.stockholders described below under “Director qualifications” (see pages 34-35).

| 22 | / | EXL 2023 Proxy Statement |

Director QualificationsOur board of directors

The board of directors considers it paramount to achieving excellence in corporate governance to assemble a board of directors that, taken together, has the skills, qualifications, experience and attributes appropriate for functioning as the board of directors of our Company and working productively with management. The Nominating and Governance Committeename, age (as of the Board is responsible for recommending nominees that are qualified and that bring a diverse setdate of skills and qualifications to oversee the Company effectively.

|

The Nominating and Governance Committee has not formally established any minimum qualifications for director candidates. However, in light of our business, the primary areas of experience, qualifications and attributes typically sought by the Nominating and Governance Committee in director candidates include, but are not limited to, the following primary areas:

|

|

|

|

|

|

|

|

|

|

|

|

We note that, in addition to satisfying these general qualifications considered by the Nominating and Governance Committee in connection with a director nomination, Vikram S. Pandit was appointed to the Board on October 4, 2018 as a Class III director pursuant to the terms of an Investment Agreement, dated as of October 1, 2018 (the “Investment Agreement”)this Proxy Statement), between the Company and Orogen Echo LLC, an affiliate of The Orogen Group LLC (the “Purchaser”). The Investment Agreement was entered into in connection with our issuance to the Purchaser of $150,000,000 in aggregate principal amount of 3.50% Convertible Senior Notes due October 1, 2024 (the “notes”). For so long as the Purchaser has the right to nominate a director to the Board under the Investment Agreement, we have, subject to the terms of the Investment Agreement, agreed to include such person in our slate of nominees for election to our board of directors at each of our annual meetings of stockholders at which directors are to be elected, and to use our reasonable best efforts to cause the election of such person to our board of directors. The Purchaser’s right to nominate a director will terminate if Purchaser and its affiliates beneficially own less than 50% of the number of shares of our common stock deemed beneficially owned by the Purchaser and its affiliates immediately following the issuance of the notes (which, for purposes of the Investment Agreement, includes shares of our common stock issuable upon conversion of the notes).

Board of Directors

The names, ages and principal occupations (which have continued for at least the past five years unless otherwise indicated)occupation and other information, including the specific experience, qualifications, attributes or skills that led to the conclusion that such person should serve as a director of the Company, with respect to each of the nominees and continuing directors are set forth below. There are no family relationships among any of our directors or executive officers.

Class I Directors (Terms ExpiringNominees for election at the Annual Meeting)Meeting - Biographical information

Vikram S. Pandit Director since October 2018 | Chairman of the Board since 2022 | Independent |

| Age: 66 — is Chairman and Chief Executive Officer of The Orogen Group, which makes significant long-term strategic investments in financial services companies and related businesses. Mr. Pandit’s business experience and directorships are detailed below. The Company has concluded, based in part on Mr. Pandit’s more than 30 years of experience in the financial services industry, including his experience as Chief Executive Officer, and a member of the board of directors, of Citigroup Inc. (NYSE: C), that Mr. Pandit should serve as a director. Committees: • Compensation and Talent Management (from March 2023); Nominating and Governance • Audit* (through February 2023) Business experience • Chairman and Chief Executive Officer, The Orogen Group LLC (July 2016 - present) • Chairman, TGG Group (February 2014 - June 2016) • Chief Executive Officer, Citigroup Inc. (December 2007 - October 2012) Public directorships during past five years • ��Director and member of the nominating and governance and finance committees, Virtusa Corporation (NASDAQ: VRTU) (2017 - 2021) • Lead Independent Director, chair of the human resources and compensation committee and member of the corporate governance and nominating committee, former member of the audit committee, Bombardier Inc. (TSX: BBD) (2014 - 2021) Other relevant experience • Director, Citigroup Inc. (December 2007 - October 2012) • Director, Fair Square Financial Holdings (2017 - 2021) • Director, Westcor Land Title Insurance Company (2020 - present) • Chairman, JM Financial Credit Solutions Ltd. (2014 - present) • Member of the Board of Overseers of Columbia Business School • Member of the Board of Visitors of Columbia School of Engineering and Applied Science | |||||

| SKILLS | ||||||

| Finance and accounting | |||||

| Executive leadership (within the last 5 years) | |||||

| Public company governance | |||||

| Analytics | |||||

| Human capital management | |||||

| Digital operations and solutions | |||||

| Global experience | |||||

| Mergers and acquisitions | |||||

* Audit committee financial expert under applicable SEC rules and regulations

| EXL 2023 Proxy Statement | / | 23 |

Our board of directors

Rohit Kapoor Director since November 2002 | Vice Chairman and CEO since April 2012 | Non-independent |

| ||||||

| Age: | |||||

Committees:N/A |

Business Experience

Business experience at the Company

•Vice Chairman and CEO (2012 |

•President and CEO (2008 |

•Various senior leadership roles, including CFO and COO (2000 |

Other Business Experience

Other business experience •Business head, Deutsche Bank, a financial services provider |

| (1999 - 2000) •Various capacities at Bank of America in the United States and Asia, including India |

Public Directorships during Past Five Years(1991 - 1999)

Public directorships during past five years • Lead independent director, director and member of the audit committee, CA Technologies, Inc. (NASDAQ: CA), a software services company Other relevant experience • Member, Board of Directors, American India Foundation (AIF) • Member, Board of Directors, Pratham (Tristate Chapter) | ||||

SKILLS | ||||

| Finance and accounting | |||

| Executive leadership (within the last 5 years) | |||

| Public company governance | |||

| Analytics | |||

| Human capital management | |||

| Digital operations and solutions | |||

| Marketing | |||

| Global experience | |||

| Risk oversight and management | |||

| Mergers and acquisitions | |||

Other Relevant Experience

| 24 | / | EXL 2023 Proxy Statement |

Our board of directors

Andreas Fibig Director since | Independent |

| ||||||

| Age: Committees: • Audit Committee; Nominating and Governance Committee Business experience • Chairman and Chief Executive Officer, International Flavors & Fragrances, Inc., a food ingredients, beverage, scent, healthcare and biosciences company (2014 - 2022) • President and Chairman of the Board of Management, Bayer Healthcare Pharmaceuticals, LLC a global pharmaceutical company (2008 - 2014) • Senior Vice President/General Manager and various leadership positions, Pfizer, Inc., a multinational pharmaceutical and biotechnology company (2000 - 2008)) Public directorships during past five years • Director, International Flavors & Fragrances, Inc. (2011 - 2022, Chairman from 2014 - 2022) • Independent director and member of the • Independent director and member of the audit committee and finance and risk policy committee, Bunge Limited (NYSE: BG), a global agribusiness and food company (2016 - 2018) Other relevant experience • Director, Indigo Agriculture, an agricultural technology company (2022 - present) • Director, EvodiaBio, a bioindustrial aroma company (2022 - present) | |||||

SKILLS | ||||||

| Executive leadership (within the last 5 years) | |||||

| Public company governance | |||||

| Human capital management | |||||

| Marketing | |||||

| Global experience | |||||

| ESG | |||||

| Mergers and acquisitions | |||||

| EXL 2023 Proxy Statement | / | 25 |

Our board of directors

Som Mittal Director since December 2013 | Independent |

| Age: 71 — has held various corporate leadership roles in the IT industry since 1989 and also has extensive experience in the engineering and automotive sectors. His business experience and directorships are detailed below. The Company has concluded, based in part on Mr. Mittal’s business experience as President of NASSCOM, his knowledge of the global outsourcing industry and his expertise in corporate sustainability and responsibility, that Mr. Mittal should serve as a director. Committees: • Compensation and Talent Management, Nominating and Governance Business experience • Chairman and President, NASSCOM, a trade body for the IT and business process management industries in India (2008 - 2014) • Prior leadership roles at Wipro, Digital, Compaq and HP • Prior executive roles at Larsen and Toubro, Escorts and Denso Public directorships during past five years • Director, Sasken Technologies Limited (NSE: SASKEN), a telecommunications company (2022 - present) • Director and member of clinical quality and innovation committee, Apollo Hospitals Enterprise Limited (NSE: APOLLOHOSP), a healthcare services provider (2021 - present) • Director and chairman of audit committee, Sheela Foam Ltd. (NSE: SFL), a manufacturing company (2016 - present) • Director and member of audit and risk management committee, Cyient Ltd. (NSE: CYIENT), an engineering design services company (2014 - 2022) • Director and chairman of customer service committee and IT strategy committee, member of nomination and remuneration committee and other committees, Axis Bank, Ltd. (NSE: Axis), a financial services company (2011 - 2019) Other directorships • Director, Tata SIA Airlines, Ltd., an Indian airline joint venture between TATA and Singapore Airlines with Indian and international operations (2015 - present) • Non executive Independent Director and Chairman, Vodafone India Services India Pvt Ltd., an Indian shared services company that is wholly owned, operated and controlled by Vodafone Group Plc (“Vodafone”) and provides information technology and networks services, among others, to Vodafone (2020 - present) Other relevant experience • Former member, Board of Governors, Indian Institute of Corporate Affairs • Former Committee Member, Indian Prime Minister’s National e-Governance Program • Member of the governing body of Axis Bank Foundation, a non-profit organization, and member of board of governors of academic institutions | |||||

| SKILLS | ||||||

| Finance and accounting | |||||

| Executive leadership | |||||

| Public company governance | |||||

| Human capital management | |||||

| Digital operations and solutions | |||||

| Global experience | |||||

| Risk oversight and management | |||||

| Information and cybersecurity | |||||

| ESG | |||||

| 26 | / | EXL 2023 Proxy Statement |

Our board of directors

Kristy Pipes Director since January 2021 | Independent |

| Age: 64 — is a leader in the professional services industry. Ms. | |||||

Committees: • Audit (Chair)*; Compensation |

Business Experience

Business experience • Chief Financial Officer, member of the |

• Vice President and Manager, Finance Division, Transamerica Life Companies (1997 - 1999) • Senior Vice President and Chief of Staff for the President and CEO, among other senior management Public directorships during past five years • Director and |

Public Directorships During the Past Five Years

•Director • Director and chair of the audit committee, and member of the Other relevant experience • Director and chair of the audit committee, and member of the nominating, governance, and sustainability committee, Savers, Inc., one of the world’s largest thrift retailers | ||||

SKILLS | ||||

| Finance and accounting | |||

| Executive leadership (within the last 5 years) | |||

| Public company governance | |||

| Analytics | |||

| Human capital management | |||

| Global experience | |||

| Risk oversight and management | |||

| Information and cybersecurity | |||

Other Relevant Experience

* Audit committee financial expert under applicable SEC rules and regulations.

| EXL 2023 Proxy Statement | / | 27 |

Our board of directors

Nitin Sahney Director since January 2016 | Independent | |||

| Age: 60 — Is a leader in the healthcare industry with over 25 years of experience across all areas of healthcare. Mr. Sahney’s business experience and directorships are detailed below. The Company has concluded, based in part on Mr. Sahney’s experience as CEO of PharmaCord and Omnicare, Inc. and his expertise in the healthcare industry garnered from more than two decades of experience, that Mr. Sahney should serve as a director. Committees: • Nominating and Governance (Chair); Audit* Business experience • Founder, Member-Manager and Chief Executive Officer, PharmaCord, LLC, a company that helps biopharma manufacturers address product access hurdles (2016 - present) • Operating Advisor, Clayton Dubilier & Rice Funds, a private equity firm (2016 - 2017) • President and CEO (2014 - 2015) and President and COO (2012 - 2014) of Omnicare Inc., a former New York Stock Exchange-listed Fortune 500 company in the long-term care and specialty care industries • Manager of a healthcare investment fund (2008 - 2010) • Founder and CEO of RxCrossroads, a specialty pharmaceutical company (2001 - 2007) • Prior leadership positions with Cardinal Healthcare, a global healthcare services and products company Public directorships during past five years • Director and member of the audit committee and the nominating and governance committee, Option Care Health, Inc. (NASDAQ: OPCH) (2019 - present) Other relevant experience • Member of the Board of Trustees, University of | |||

| SKILLS Finance and | |||

| Executive leadership (within the last 5 years) | |||

| Public company governance | |||

| Mergers and acquisitions | |||

* Audit committee financial expert under the applicable SEC rules and regulations

| 28 | / | EXL 2023 Proxy Statement |

Our board of directors

Jaynie M. Director since September 2018 | ||||

Independent | ||||

| Age: | |||

Committees: • Compensation and Talent Management (Chair), |

Business Experience

Business experience •Chief Operating Officer, Overture Services, a pioneer in paid search and search engine marketing |

| (2001 - 2004) •President & Chief Operating Officer, PayMyBills, the leading consumer bill payment and presentment company (1999 |

•Previously for over two decades served as Executive Vice President and Head of Consumer |

Public Directorships During the Past Five YearsCalifornia following the era of bank consolidation.

• Management Consultant, Booz, Allen & Hamilton Public directorships during past five years •Director and |

•Director and member of the contracts committee, audit committee and nomination and governance committee, Western Asset Management |

| (2004 - present) • Director and chair of the compensation committee and member of the nominating and governance committee, CoreLogic, Inc. (NYSE: CLGX) until its acquisition in 2021 (2012 - 2021) •Director, compensation committee chair and member of the compliance committee, Pinnacle Entertainment (Nasdaq: PNK) until its acquisition in 2018 (2012 |

Other relevant experience • Member of the National Association of Corporate Directors (“NACD”) Directorship 100, 2021, as one of the top public company directors in the U.S.; Named to Women Inc.’s 2019 Most Influential Corporate Directors listing • Board chair emeritus and life trustee, Huntington Health, an affiliate of Cedars Sinai Health • Trustee and board member, and member of the finance, audit |

Other Relevant Experience

SKILLS |

| Finance and accounting | |

| Executive leadership | |

| Public company governance | |

| Analytics | |

| Human capital management | |

| Digital operations and solutions | |

| Marketing | |

| Global experience | |

| Risk oversight and management | |

| ESG | |

| Mergers and acquisitions | |

*Audit committee financial expert under applicable SEC rules and regulations.

Class II Directors (Terms Expiring in 2020)

|

Business Experience

/ | 29 |

Public Directorships During Past Five Years

Other Directorships

Other Relevant Experience

*Audit committee financial expert under applicable SEC rules and regulations.

|

Business Experience

Public Directorships During Past Five Years

Other Directorships

Other Relevant Experience

|

Business Experience

Public Directorships During the Past Five Years

Other Directorships

*Audit committee financial expert under applicable SEC rules and regulations.

Class III Directors (Terms Expiring in 2021)

|

Business Experience

Public Directorships during Past Five Years

Other Directorships

|

Business Experience

Public Directorships During the Past Five Years

Other Relevant Experience

|

Business Experience

Other Relevant Experience

|

Business Experience

Public Directorships during Past Five Years

Other Directorships

Other Relevant Experience

CORPORATE GOVERNANCECorporate governance

Corporate governance

Director Independence

independence

In determining director independence, the board of directors considered the transactions and relationships set forth below under “Certain Relationships and Related Person Transactions—Related Party Transactions.” Transactions” and routine service arrangements between the Company and Westcor Land Title Insurance Company (“Westcor”). During 2022, one of our directors, Mr. Pandit, served as a non-executive director and, through his ownership in The Orogen Group (see below for information on Mr. Pandit’s relationship with The Orogen Group), owned an immaterial indirect equity interest, in Westcor. Mr. Pandit is not, and was not during 2022, a partner, controlling shareholder or executive officer of Westcor.

Based on its review of all applicable relationships, our board of directors has determined that all of the members on our board of directors, other than Mr. Kapoor, meet the independence requirements of the Nasdaq Stock Market and federal securities laws.

Meeting Attendanceattendance

OurWe expect our directors are expected to attend all board of directors meetings and meetings of committees on which they serve. Directors areWe also expectedexpect our directors to spend sufficient time and meet as frequently as necessary to discharge their responsibilities properly. Each member of our board of directors attended at least 75% of the aggregate meetings of our board of directors and the committees on which they served during 2018. It is our policy that all of our directors standing for election should attend our Annual Meetings of Stockholders absent exceptional cause. All

Incumbent director meeting attendance

Board and committee meetings in 2022

|

|

|

|

|

|

| ||||||||||||

| Board meetings | Audit Committee meetings | Compensation and Talent Management Committee meetings | Nominating and Governance Committee meetings | |||||||||||||||

| 5 | 7 | 5 | 5 | |||||||||||||||

| 30 | / | EXL 2023 Proxy Statement |

Corporate governance

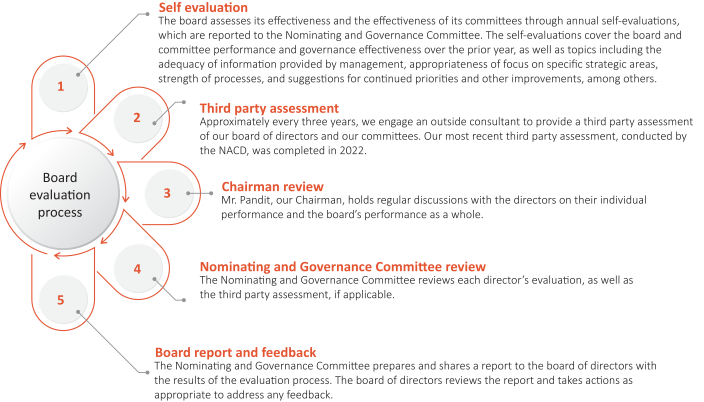

Corporate governance framework

The board is responsible for providing governance and oversight over the effectiveness of policy and decision-making with respect to the persons who were membersstrategy, operations and management of EXL, in order to enhance our financial performance and stockholder value over the board of directors atlong term.

Our board’s commitment to strong corporate governance is informed by the timefive core values of our 2018 Annual Meeting of Stockholders attended such meeting.corporate culture: innovation, respect, integrity, excellence and collaboration. Our board seeks to maintain best practices in corporate governance by reviewing and updating our governance policies, as appropriate, at least annually, and provides oversight over our risk management and strategic planning as relates to our growth, human capital management, and environmental, social and governance matters, each as discussed further below.

Our Corporate Governance Guidelines and other governance policies, including our committee charters and Code of Conduct and Ethics, codify our corporate governance framework. | ||||||||

The Corporate Governance Guidelines address Board responsibilities and conduct, director qualifications and membership matters, director orientation and continuing education, Board and committee meetings, and share ownership by non-management directors, among other topics. | Our Code of Conduct and Ethics is applicable to our directors, officers and fully and part-time employees, and anyone who works on EXL’s behalf, including suppliers, subcontractors and partners, and details how they should conduct themselves when dealing with fellow employees, clients, suppliers, partners, competitors and the general public. Our Code of Conduct and Ethics is reviewed annually by the Audit Committee and audited periodically as part of our compliance and legal audits. Our personnel receives periodic training on the Code. We encourage our employees to speak up and raise concerns promptly about any situation that they believe may violate our Code of Conduct and Ethics or the law and we are committed to responding promptly to any concerns. Our Corporate Governance Guidelines, committee charters, and other corporate governance policies are all available on our website at https://ir.exlservice.com/corporate-governance. | |||||||

Our committee charters specifically set out the authority and responsibilities of the Committees of the board. | ||||||||

| EXL 2023 Proxy Statement |

| 31 |

Board Leadership StructureCorporate governance

OurBeyond the board of directors is currently led by Garen K. Staglin, our Chairman, and Rohit Kapoor, our Vice Chairman and CEO.room

Director onboarding | ||||||||||

| All new directors participate in an orientation program shortly after their election or appointment, which is overseen by the Nominating and Governance Committee. New directors | |||||||||

| | participate in site visits and presentations by senior management. By the end of orientation, our new directors are familiar with our: • strategic and business plans • significant financial, accounting and risk management • compliance programs, and • corporate governance framework. | |||||||||

Employee and stockholder engagement | ||||||||||

| Our directors are generally invited to visit any EXL office and have complete and open access to our management and employees. | |||||||||

| | They also take part in EXL company initiatives in which they can engage with our employees, stakeholders and community members directly. • In March 2023, together with our employee volunteers •Mr. Pandit participated in our 2022-2023 stockholder | |||||||||

Director continuing education | ||||||||

| We encourage our board members to participate in director continuing education (“DCE”): • We provide reimbursements for participation in DCE courses | |||||||

• We maintain a subscription for our directors with the National Association of Corporate Directors (“NACD”) and our directors actively take part in NACD offerings. For example, Ms. Studenmund is on an NACD Southern California special committee that meets regularly to discuss compensation committee matters • We provide regular updates to our directors on corporate governance and ESG matters, executive compensation developments and trends, accounting standards changes, risk management matters and other legal and other topics of interest from a variety of internal and external sources. Our directors are active DCE participants: For example, in 2022, Ms. Pipes: • attended the annual KPMG Board Leadership Conference, • participated in over 50 hours of courses and trainings on cybersecurity and ESG, among other topics, and • received an NACD Cybersecurity certification following her participation in the NACD’s course on Cybersecurity led by Carnegie Mellon University. Certain of our directors are also involved in industry-level governance matters. For example: • Mr. Mittal is the former president and chairman of the National Association of Software and Service Companies (“NASSCOM”), an Indian trade association and governance group focused on the information technology and business process outsourcing industry, in which we, and many of our U.S. peer companies with operations in India, are members. He advises NASSCOM on best practices for corporate governance and is currently assisting NASSCOM in the development of data privacy legislation in India. | ||||||||

|

|

|

|

|

| |||||||||

Anne Minto Independent director | Kristy Pipes Independent director | Rohit Kapoor Vice Chairman and CEO | Vikram Pandit Independent Chairman | Som Mittal Independent director | Jaynie Studenmund Independent director |

| 32 | / | EXL 2023 Proxy Statement |

Corporate governance

Board leadership structure

Vikram Pandit Independent Chairman |

Rohit Kapoor Vice Chairman | Our board of directors is currently led by Vikram Pandit, our Chairman, and Rohit Kapoor, our Vice Chairman and CEO. Our Fifth Amended and Restated By-laws (our “By-laws”) provide that our Chairman or, in the absence of our Chairman, our Lead Director (if there is a Lead Director serving at such time), or in the absence of both our Chairman and Lead Director, our CEO, calls meetings of our board of directors to order and acts as the chair for those board meetings. In the absence of our Chairman, our Lead Director (if there is a Lead Director serving at such time), and our CEO, a majority of our directors present may elect as chair of the meeting any director present. Independent directors meet at least quarterly in executive session without any management | ||

| directors or members of the Company’s management present. Our Corporate Governance Guidelines provide that in the absence of our Chairman, our Lead Director (if there is a Lead Director serving at such time) or, in the absence of the Lead Director, a director chosen by the directors meeting in executive session, presides at all executive sessions. | ||||

Our by-laws provide that our Chairman or, in the absence of our Chairman, our Lead Director (if there is a Lead Director serving at such time), or in the absence of both our Chairman and Lead Director, our CEO, shall call meetings of our board of directors to order and shall act as the chairman thereof. In the absence of our Chairman, our Lead Director (if there is a Lead Director serving at such time), and our CEO, a majority of our directors present may elect as chairman of the meeting any director present. Independent directors meet at least quarterly in executive session without any management directors or members of the Company’s management present. The Lead Director or, in the absence of the Lead Director, a director chosen by the directors meeting in executive session, presides at all executive sessions.

Consolidating the Vice Chairman and CEO positions allows our CEO to contribute his experience and perspective regarding management and leadership of the Company towards the goals of improved corporate governance and greater management accountability. In addition, the presence of our Chairman ensures that the board can retain sufficient delineation of responsibilities, such that our Chairman and our Vice Chairman and CEO may each successfully and effectively perform and discharge their respective duties and, as a corollary, enhance our prospects for success. As a result, the Company will benefit from the ability to integrate the collective leadership and corporate governance experience of our Chairman and our Vice Chairman and CEO, while retaining the ability to facilitate the functioning of the board of directors independently of our management and to focus on our commitment to corporate governance.

For the foregoing reasons, our board of directors has determined that its leadership structure is appropriate and in the best interests of our stockholders at this time.

| EXL 2023 Proxy Statement | / | 33 |

Majority Voting in Director Elections

Corporate governance

Under our by-laws,Director qualifications, refreshment and evaluations

Director qualifications

Key skills and attributes we look for in board nominees

|

The board of directors who are standingconsiders it paramount to achieving excellence in corporate governance to assemble a board of directors that, taken together, has the breadth of skills, qualifications, experience and attributes appropriate for election in an uncontested election are elected by the affirmative vote of a majority of votes cast (meaning the number of shares voted “for” a nominee must exceed the number of shares voted “against” such nominee) in person or represented by proxy and entitled to vote at the meeting. If any incumbent nominee for director in an uncontested election receives a greater number of votes “against” his or her election than votes “for” such election, our by-laws provide that such person shall tender tofunctioning as the board of directors his or her resignation asof our Company and working productively with management. The Nominating and Governance Committee of the board is responsible for recommending nominees who are qualified and bring a director. (In contested elections,diverse set of skills and qualifications to oversee the Company effectively.

The Nominating and Governance Committee has not formally established any

minimum qualifications for director candidates, but pursuant to our Corporate

Governance Guidelines, our board of directors will be electedseeks members from diverse

professional and personal backgrounds who combine a broad spectrum of experience

and expertise with a reputation for integrity. The Nominating and Governance

Committee assesses each director candidate’s independence, diversity (including age,

ethnicity, race and gender, among others), skills and experience in the context of the needs of the board of directors. The Nominating

and Governance Committee considers a number of factors in selecting director candidates, including, among others: ethical standards

and integrity; independence; diversity of professional and personal backgrounds; skills and experience; other public company